Understanding IDR Plans for Student Loans: A Lifeline for Borrowers in the United States

Student loans ( idr plans student loans ) are a reality for millions of Americans. With the rising cost of higher education, many graduates find themselves burdened with debt that can take decades to repay. For those struggling to make ends meet, Income-Driven Repayment (IDR) plans offer a glimmer of hope. These plans are designed to make student loan payments more manageable by tying them to your income and family size. In this article, we’ll explore what IDR plans are, how they work, and why they might be the right choice for you.

What Are IDR Plans?

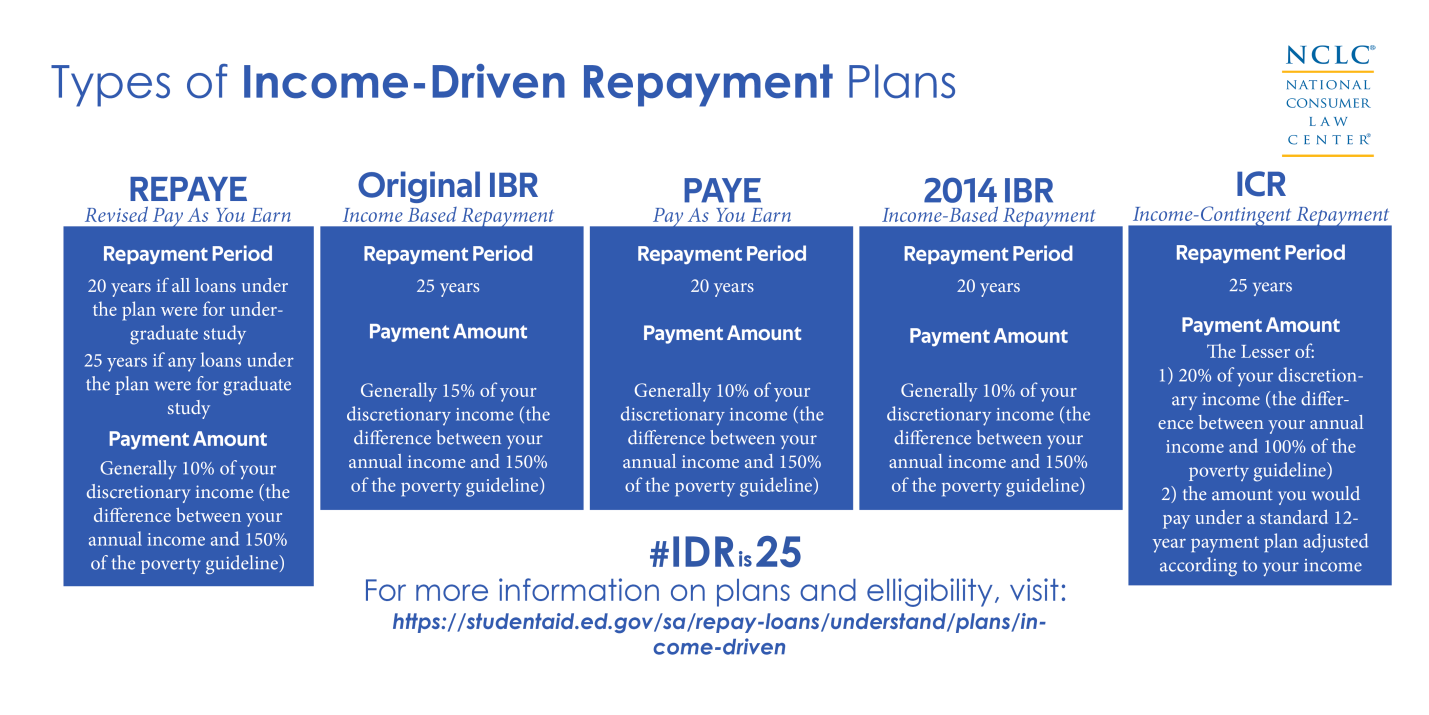

Income-Driven Repayment (IDR) plans are federal student loan repayment options that adjust your monthly payments based on your income and family size. The goal is to ensure that your student loan payments are affordable, even if your income is low. There are four main types of IDR plans available in the United States:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

Each plan has its own eligibility requirements and payment calculations, but they all share the same core principle: your payments are capped at a percentage of your discretionary income.

How Do IDR Plans Work?

The process of enrolling in an IDR plan is straightforward, but it requires some paperwork. Here’s a step-by-step breakdown:

- Check Your Eligibility: Not all federal student loans qualify for IDR plans. Generally, Direct Loans and FFEL Program loans are eligible, but private loans are not.

- Choose the Right Plan: Each IDR plan has different terms and conditions. For example, PAYE and IBR cap your payments at 10% or 15% of your discretionary income, while REPAYE has no income requirement but caps payments at 10%.

- Submit an Application: You can apply for an IDR plan online through the U.S. Department of Education’s website. You’ll need to provide information about your income and family size.

- Recertify Annually: Your income and family size can change over time, so you’ll need to recertify your information every year to stay on the plan.

One of the most significant benefits of IDR plans is that after 20 or 25 years of qualifying payments (depending on the plan), any remaining balance is forgiven. This can be a game-changer for borrowers with large loan balances and modest incomes.

Why IDR Plans Matter

For many Americans, student loan debt is a heavy burden that can delay major life milestones like buying a home, starting a family, or saving for retirement. IDR plans offer a way to ease this burden by making payments more affordable.

Consider the story of Sarah, a 28-year-old teacher from Ohio. After graduating with 50,000instudentloans,Sarahfoundherselfstrugglingtomakehermonthlypaymentsonhermodestsalary.SheenrolledinanIDRplan,whichreducedherpaymentstojust150 a month. This allowed her to focus on her career and even start saving for a down payment on a house.

IDR plans also provide a safety net for borrowers who experience financial hardship. If you lose your job or face a significant drop in income, your payments can be adjusted accordingly. In some cases, your payment could even drop to $0.

Common Misconceptions About IDR Plans

Despite their benefits, IDR plans are often misunderstood. Here are a few myths debunked:

- Myth 1: IDR plans are only for low-income borrowers.

While IDR plans are designed to help those with lower incomes, they can also benefit higher-income borrowers with high loan balances. - Myth 2: Forgiveness is guaranteed after 20-25 years.

Forgiveness is only granted if you make qualifying payments for the entire period. Missing payments or failing to recertify can delay forgiveness. - Myth 3: IDR plans are too complicated to navigate.

While the application process can seem daunting, resources like StudentAid.gov provide step-by-step guidance to help you through it.

How to Get Started with an IDR Plan

If you’re considering an IDR plan, the first step is to gather all the necessary information. This includes details about your income, family size, and loan balances. You can use the Loan Simulator tool on the Federal Student Aid website to compare different repayment options and see how much you could save with an IDR plan.

Once you’ve chosen a plan, submit your application online. If you need help, don’t hesitate to reach out to your loan servicer or a financial advisor.

The Future of IDR Plans

The Biden administration has made student loan relief a priority, and IDR plans are a key part of that effort. Recent changes to the program have made it easier for borrowers to qualify for forgiveness and have streamlined the application process.

For example, the Limited PSLF Waiver has allowed thousands of public service workers to receive loan forgiveness through IDR plans. Additionally, the Department of Education is working on improving the recertification process to make it less burdensome for borrowers.

Final Thoughts

Student loan debt doesn’t have to control your life. IDR plans offer a flexible and affordable way to manage your payments and work toward financial freedom. Whether you’re just starting your career or facing unexpected financial challenges, an IDR plan could be the solution you’ve been looking for.

If you’re ready to take control of your student loans, visit StudentAid.gov to learn more about IDR plans and start your application today.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. For personalized guidance, consult a financial advisor or loan servicer.

Backlinks:

By understanding and utilizing IDR plans, borrowers in the United States can take a significant step toward financial stability and peace of mind.